In Part 4, we exposed the UPI trap — how convenience is being weaponized to centralize control over your money.

Now we confront the next illusion:

That “saving money” in rupees — or in the bank — is actually helping you build wealth.

The reality?

It’s the surest way to lose it.

Let’s break down how.

🏦 “Safe” Savings Are a Lie

We’re taught from childhood:

Save in a savings account

Earn “interest” over time

Let your money grow safely in a bank

But this advice is dangerously outdated — and deliberately misleading.

Here’s why:

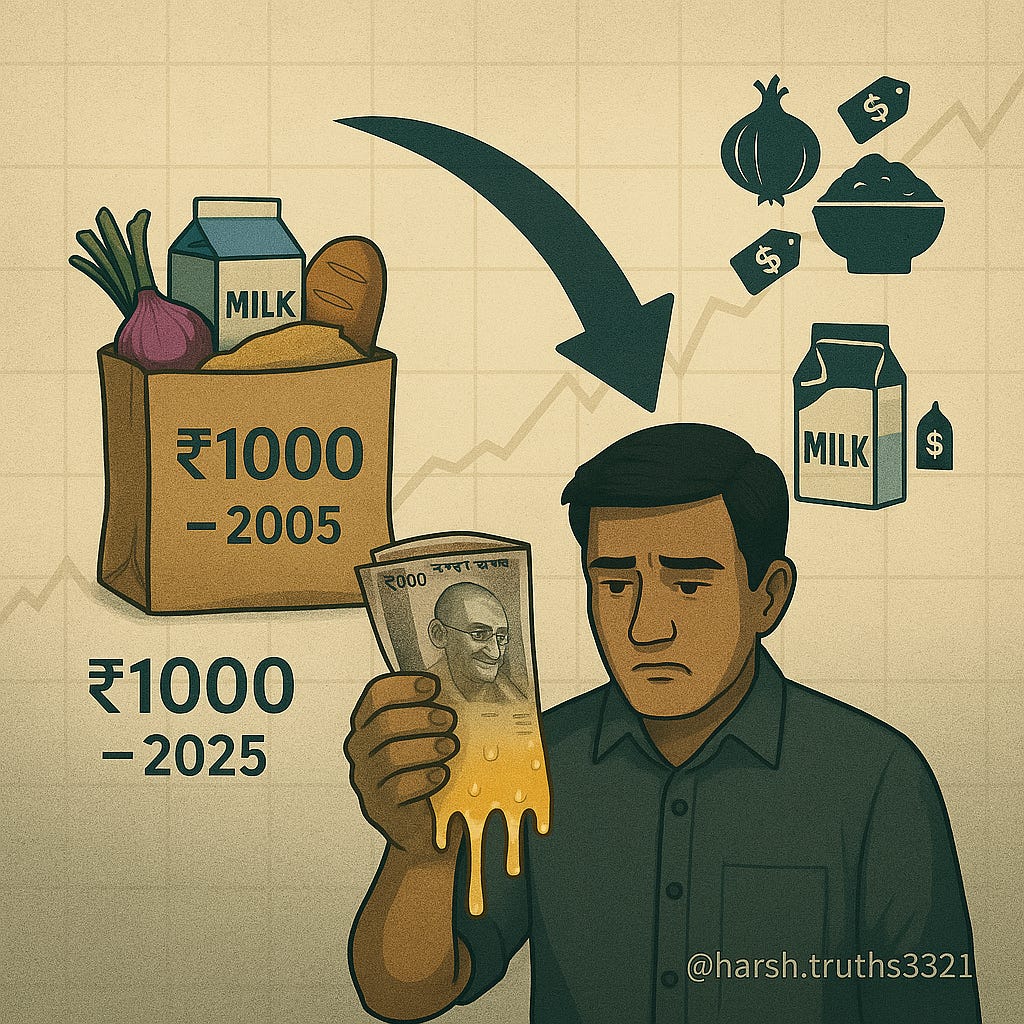

📉 The Rupee is Always Losing Value

Inflation in India officially averages 5–6% per year.

That means:

₹1,00,000 today = ₹94,000 in purchasing power next year

Over 10 years, you’ve lost half your value in real terms

Now look at your savings account. Most offer 2–4% interest annually.

You’re not gaining — you’re losing.

This is theft by stealth

.

Why Inflation Steals from the Poor

Inflation is called a “hidden tax” for a reason:

It’s not voted on

It doesn’t show up on your paycheck

But it erodes your wealth every second

And the people hit hardest?

Savers

Fixed income earners

The middle class trying to “do the right thing”

Meanwhile, those closest to the money printer — governments, banks, large corporations — benefit from freshly created currency before prices rise.

This is called the Cantillon Effect.

It’s not a bug. It’s the system working as designed.

🏚️ The Real Risk Isn’t Spending — It’s Saving

If you keep your money:

In a savings account

As cash under the mattress

In FDs or low-yield instruments

You’re bleeding purchasing power daily.

You might feel “safe” seeing a balance of ₹1,00,000 in your account —

But that amount will buy you less and less every year.

“If you don’t find a way to make your money work while you sleep, you will work until you die.” — Warren Buffett

🔑 The Answer: Sound Money

Throughout history, civilizations have always returned to one principle:

Money must be hard to create — or it becomes worthless.

Let’s compare:

💡 Why Bitcoin is Crucial

Bitcoin isn’t just an “investment.” It’s a monetary revolution.

It’s the hardest money ever created

Its supply is capped at 21 million — forever

No one, not even governments, can change the rules

It can’t be inflated, censored, or seized (if self-custodied)

If the rupee is leaking value daily,

Bitcoin is a lifeboat.

But What About Gold?

Gold is a proven store of value across 5,000+ years.

It:

Holds its purchasing power over time

Can’t be printed

Is universally accepted

But it has drawbacks:

Physical risk (theft, storage)

Hard to divide or transfer

Subject to import duties and regulation

That’s why many opt to hold both:

Gold for stability. Bitcoin for portability and growth.

🚨 Why You Must Exit the Rupee

Let’s be clear:

We’re not saying abandon rupees entirely.

You need it for daily life — bills, food, rent, business.

But saving in rupees?

That’s wealth suicide.

Start reallocating:

Emergency fund: maybe 3–6 months in rupees

Everything else: Gold, Silver, Bitcoin (in self-custody)

This is not just wealth protection. It’s wealth preservation

.

🧠 Final Thoughts

“You can ignore reality, but you can’t ignore the consequences of ignoring reality.” — Ayn Rand

If you save in a melting ice cube (rupee),

You’ll be left with cold hands and empty pockets.

If you switch to scarce, sound money —

You give yourself a fighting chance.

You reclaim sovereignty over your time, energy, and future

.

🔔 Coming Up in Part 6:

Why governments want a cashless society

The dangerous reality of CBDCs (Central Bank Digital Currencies)

How your digital payments can be used to punish, restrict, or silence

And how to prepare for a future without financial freedom

How the Indian payment revolution may be paving the road to financial slavery — one scan at a time.

Learn more about Indian Bank Collapses here.

Read more about Fractional Reserve Banking here.